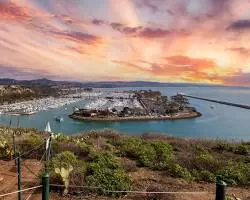

How to Buy Dana Point Real Estate from Out-of-State in 2025 (Remote Buyer Guide)

A step-by-step playbook for remote buyers: financing, virtual tours, inspections, escrow, and closing in California—without multiple trips.

Buying Dana Point real estate from out of state requires strategic planning, local expertise, and leveraging virtual technology to navigate California's competitive coastal market. Remote buyers can successfully purchase property by securing mortgage pre-approval, hiring an experienced local agent, conducting thorough virtual tours, coordinating professional inspections remotely, and utilizing California's electronic closing procedures to complete transactions without traveling multiple times.

How to Buy a Home in Dana Point CA from Out of State

Dana Point's luxury coastal real estate market continues to attract out-of-state buyers seeking Southern California's premier beachfront lifestyle. With median home prices reaching $2.0 million in 2025 and properties selling within an average of 29 days, remote buyers must navigate a fast-paced market where preparedness and local expertise determine success.

The process of purchasing Dana Point real estate remotely has evolved significantly with technological advancements and California's adoption of remote closing procedures. Out-of-state buyers can now complete entire transactions from their home state while maintaining confidence in their investment decisions. For general guidance on relocating to Dana Point, see our comprehensive relocation guide.

Understanding the Dana Point Real Estate Market in 2025

Current Market Conditions

- Median Home Price: $1.68 million to $2.0 million

- Average Days on Market: 29 days

- Year-Over-Year Price Growth: 5.8%

- Homes Selling Above Asking: 22%

- Property Tax Rate: Approximately 1.18% effective rate

The competitive nature of Dana Point's market requires remote buyers to act decisively while conducting comprehensive due diligence. Properties in desirable neighborhoods frequently receive multiple offers within the first week of listing. Understanding the pros and cons of living in Dana Point helps remote buyers make informed decisions before committing to the market.

Dana Point Neighborhood Price Ranges

For detailed insights into each neighborhood, see our complete guide to Dana Point's best neighborhoods in 2025.

| Neighborhood | Price Range | Key Features |

|---|---|---|

| Dana Hills | $1.0M - $1.8M | Family-friendly, excellent schools, inland location |

| Lantern Village | $1.2M - $2.5M | Walkable harbor lifestyle, restaurants, shops |

| Capistrano Beach | $1.3M - $3.0M | Relaxed surf culture, beachfront access |

| Niguel Shores | $1.5M - $4.0M | Guard-gated, comprehensive amenities, tennis courts |

| Monarch Bay | $2.0M - $8.0M | Ultra-luxury, private beach club, guard-gated |

| The Strand at Headlands | $10M - $25M+ | Oceanfront estates, panoramic views, exclusive |

Step 1: Pre-Purchase Preparation for Remote Buyers

Secure Mortgage Pre-Approval Before House Hunting

Obtaining mortgage pre-approval represents the critical first step for out-of-state buyers targeting Dana Point real estate. Pre-approval differs from pre-qualification by involving a comprehensive financial review and hard credit check.

Required Documentation for California Mortgage Pre-Approval:

- Government-issued photo identification and social security number

- Recent pay stubs covering the last 30 days

- W-2 forms from the previous two years

- Bank statements from all accounts (last two months)

- Federal tax returns if self-employed or claiming rental income

- Documentation of all debt obligations

- Proof of down payment funds and their source

Pre-approval letters typically remain valid for 60 to 130 days. Many California lenders offer fully online application processes, allowing out-of-state buyers to complete pre-approval without visiting California. In Dana Point's competitive market, sellers prioritize offers from pre-approved buyers who demonstrate financial readiness.

Research Dana Point Neighborhoods Virtually

Financial Considerations by Neighborhood:

- Property tax assessments vary by zip code, with median annual bills ranging from $8,244 to $8,772

- HOA fees fluctuate dramatically from $200–$400 monthly in Dana Woods to over $1,000 in luxury oceanfront communities

- Mello-Roos taxes and special assessments apply in certain newer developments

For comprehensive expense details, review our cost of living analysis.

Lifestyle Factors:

- School district ratings and boundaries for families with children

- Walkability scores (Dana Point averages 53 citywide, but varies by neighborhood)

- Proximity to beaches, harbor amenities, shopping, and dining

- Commute times to employment centers in Orange and San Diego Counties

Understanding Dana Point's year-round climate is also essential for remote buyers evaluating coastal living conditions.

Hire a Dana Point Real Estate Agent Experienced with Remote Buyers

Essential Agent Services for Remote Buyers:

- Micro-market expertise and pricing trends

- Access to off-market and pre-market opportunities

- Coordination of virtual tours and detailed video walkthroughs

- Representation at inspections and showings

- Negotiation strength in multiple-offer scenarios

- Fluency with California disclosures and transaction customs

- Vetted network: inspectors, contractors, lenders

Step 2: Conducting Virtual Property Searches

Leveraging Technology for Remote Property Viewing

- 3D Virtual Tours (Matterport, etc.) for 360° exploration

- Live Video Walkthroughs for interactive Q&A

- Drone/Aerial Footage for oceanfront and view properties

- Virtual Neighborhood Exploration via Street View and area videos

Maximizing Virtual Tour Effectiveness

Virtual tours are powerful, but they can’t fully capture finishes, scale, noise, and light—verify during inspections or an in-person visit when possible.

Acting Quickly in a Fast-Moving Market

- Decide fast after tours go live

- Submit offers electronically within hours/days

- Be reachable during CA business hours

- Share clear parameters so your agent can move

For sellers, timing is equally critical—see our guide on selling your Dana Point home for optimal market timing strategies.

Step 3: Offers & Due Diligence (Remotely)

Key California Contingencies

- Inspection (~17 days)

- Appraisal (~17 days)

- Loan (~21 days)

In multiple-offer settings, shorten periods rather than waiving outright where possible.

Earnest Money Deposits

- Typically 1%–3% of purchase price; due within 3 business days

- Held in neutral escrow; refundable if you cancel within contingencies

- Always verify wire instructions by phone with escrow

Step 4: Coordinating Professional Inspections

Coastal considerations: salt-air exposure, bluff erosion, drainage, roof wear, HVAC performance near ocean.

Remote-friendly services: photo/video reports, virtual attendance, drone/IR, sewer scopes.

Step 5: Navigating Escrow (30–45 Days Typical)

- Days 1–3: Deposit to escrow

- Days 1–17: Inspections & appraisal

- Days 1–21: Loan approval

- ~Day 25: Contingency removals, loan docs

- ~Day 30–45: Final walk-through & closing

Step 6: Remote Closing Options

Remote Online Notarization (RON)

- Schedule with RON-certified notary

- Secure video session + ID verification

- E-sign while connected

- Documents return to escrow for recording

Alternatives: mobile notary, limited POA, or travel to sign. No matter what, practice strict wire-fraud hygiene.

Step 7: Title Insurance & Closing Costs

- CLTA (standard) vs ALTA (extended) coverage

- Buyer costs often 2%–5% of price (loan type & property dependent)

| Expense Category | Estimated Cost |

|---|---|

| Lender Fees | $3,000 – $6,000 |

| Title Insurance (ALTA) | $3,500 – $5,000 |

| Escrow Fees | $2,000 – $4,000 |

| Inspections | $600 – $1,500+ |

| Appraisal | $600 – $1,000 |

| Insurance (Year 1) | $2,000 – $5,000+ |

| Recording/HOA/Other | Varies |

Step 8: After Closing (Remote Owners)

- Consider property management (inspections, utilities, vendors)

- Set up SCE, SoCalGas, South Coast Water, trash, internet

- Review insurance (wildfire, earthquake, flood as needed)

- Study HOA rules (dues, design review, rentals, beach clubs)

For remote owners interested in generating income, review our analysis of Dana Point investment properties and short-term rental regulations.

Common Mistakes to Avoid

- Rushing due diligence

- Relying solely on virtual tours

- Underestimating total ownership costs

- Hiring non-local pros unfamiliar with coastal nuances

- Poor time-zone communication planning

Financing Options

- Compare CA local vs national lenders (speed, appraisers, costs)

- Expect 20%+ down on jumbo; cash offers are common (25%–35%)

- Lock rates (30–60 days typical)

Market Trends (2025)

- Low inventory supports pricing; be decisive

- 30-yr fixed around mid-6% to mid-7% for well-qualified

- Remote work keeps demand resilient

- Lifestyle: beaches, harbor, year-round mild climate

Legal Considerations

- Robust disclosures (TDS, NHD, HOA docs, etc.)

- CAR forms with strict timelines & arbitration clauses

- Tax residency implications—consult your CPA

- Consider a CA trust to avoid probate on CA real estate

Dana Point Neighborhoods in Depth

Lantern Village – Walkable Harbor Lifestyle

Walk to restaurants, shops, marina; mix of cottages and new builds; vibrant scene; limited parking in pockets.

Monarch Beach – Ultra-Luxury Oceanfront Living

Guard-gated enclaves, private beach club access, resort adjacency, custom homes, golf & country club options.

Niguel Shores – Amenitized Coastal Community

Gated, pools/tennis/clubhouse, bluff-top trails, private beach access, active social calendar.

Capistrano Beach – Relaxed Surf Culture

Casual vibe, direct beach access, older cottages + newer homes, typically lower HOAs.

Dana Hills – Family-Oriented Inland Value

Great schools, larger lots, parks, and comparatively more square footage per dollar.

Special Considerations for Specific Buyer Types

Retirees and Downsizers

Out-of-state retirees find Dana Point particularly appealing for its mild climate and active lifestyle. Those interested in downsizing to a coastal condo should review HOA rules carefully, as many communities have age-specific amenities and services. Our retirement planning guide offers comprehensive insights for seniors relocating to Dana Point.

Comparing to Nearby Markets

Many out-of-state buyers evaluate Dana Point alongside neighboring Laguna Beach. Our detailed Dana Point vs. Laguna Beach comparison helps buyers understand the price, lifestyle, and community differences between these two premier coastal cities.

FAQ

Can you buy in California remotely without visiting?

Yes—via virtual tours, e-signatures, and RON. Most buyers still benefit from visiting during the inspection period.

How long does it take to close?

About 30–45 days with financing; cash can be 7–14 days when due diligence is complete.

Biggest remote-buyer challenges?

Property/neighborhood feel, time-zone coordination, attending inspections, wire-fraud risk, and seller perception. Solve with experienced local pros, clear comms, and strict security.

Categories

Recent Posts

REVIEWS